Trade Carbon credits, just like shares.

Exclusively on

Welcome to Australia's only listed marketplace for trading carbon assets

Until now, investors and organisations have been “locked out” of Australia’s carbon credit market. Access to Australian Carbon Credit Units (ACCUs) was previously restricted to wholesale investors with an Australian National Registry of Emissions Units (ANREU) account, trading exclusively through bilateral transactions.

The MyCarbon Marketplace heralds a new era of transparent and secure carbon asset trading in Australia.

Australia's newest asset class

Accessible in the same way you would utlise the Australian equity markets, MyCarbon products are issued and listed on a tier 1 licensed exchange for regulated, open and transparent trading of Australian Carbon Credit Units (ACCUs).

The time is now

The world is falling short on climate goals, and the race to close the emissions gap is accelerating. High integrity, government issued compliant carbon credits are rapidly emerging as the go-to solution for policymakers and businesses under pressure to act. With demand set to surge, now is the time to invest in the environmental assets that will shape our planet’s future.

/ Returns with Impact

Investors seeking to trade or leverage ACCUs as a valuable asset class.

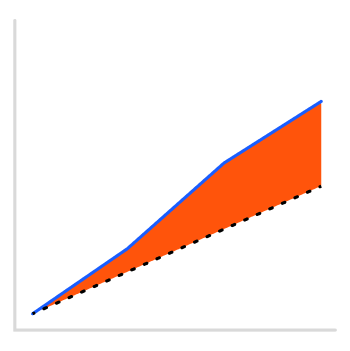

The global carbon credit market is booming, set to grow from $103.8bn in 2023 to $343.6bn by 2032. Driven by global net-zero policies, ACCUs are emerging as a fast-growing asset class – a rare opportunity for investors to achieve strong returns while supporting the world’s shift to sustainability.

Global Market Insights

/ Mandatory Disclosures

Organisations using ACCUs to offset emissions voluntarily or to meet regulatory requirements.

Carbon accountability is rapidly becoming a standard for all businesses. By 2027, even mid-sized companies ($50M+ revenue, 100+ employees) must comply with mandatory reporting, requiring transparent, reliable carbon data. Starting July 2024, asset managers with $5B+ will face strict reporting rules, making climate risks a priority. For CFOs, CEOs, and business leaders, investing in ACCUs now is a proactive way to ensure compliance and lead in sustainability.

Australian Government – The Treasury | Mandatory climate-related financial disclosures

My Carbon. My Choice. One Kilo at a Time

The data is clear: the world is not on track to meet its climate goals, and urgent action is needed. Achieving sustainable outcomes isn’t just a global goal—it’s a shared responsibility. Bold, collective action is required. Together, we can drive change and reduce the worlds of CO2 emissions, one kilo at a time. Join us today.

With Net Zero Standards Unmet, Offset Solutions Are Now Critical

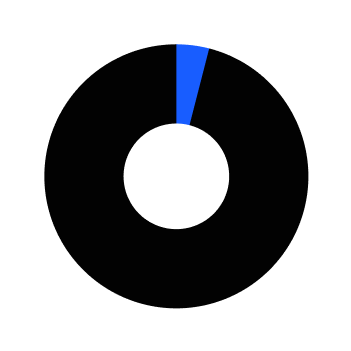

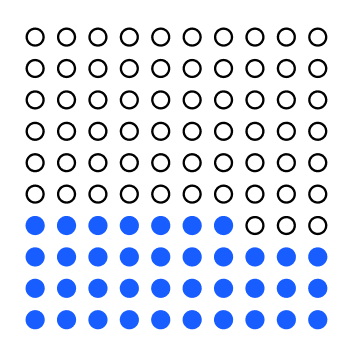

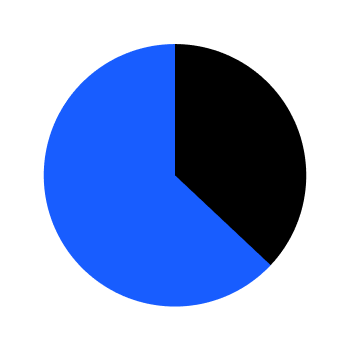

Only 4% of company net zero commitments meet the revised ‘Starting Line criteria’, set out in June 2022 by the UN Race to Zero campaign.

Source: zerotracker.net

Doubling the Pace: The Only Way to Meet Net-Zero by 2030

93% of companies will miss their zero targets

if they don’t at least double the pace of emissions reduction by 2030.

Source: Accenture

Average household data Australia

Only 37% of the 2.1 billion large city

residents live in cities that have net zero

targets.

Source: zerotracker.net

Over a Third of the World’s Largest Companies Have Yet to Commit to Greenhouse Gas Targets

37% of the world’s largest companies have yet to set any kind of GHG mitigation target.

Source: zerotracker.net

The Alarms Are Sounding: The Demand for Reduction and Offset Solutions Is Clear

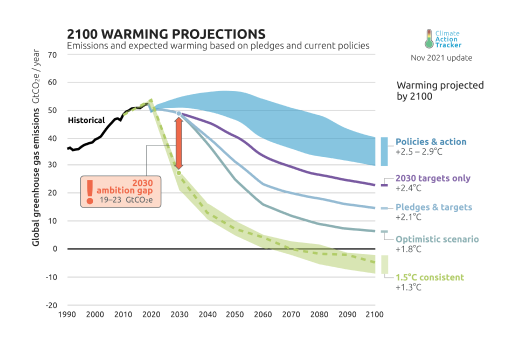

By 2030, the world faces a 19–23 GtCO₂e ambition gap between current trajectories and what’s needed for the 1.5°C target. Without urgent action, warming could exceed +2.5°C to +2.9°C, far beyond the safer 1.5°C limit.

Source: Climate Action Tracker

News

Jan 31, 2025

The ACCU market in 2024: A review of the biggest volume year in the scheme’s history

FAQ's

/ How does the MyCarbon Marketplace differ from other carbon trading platforms?

MyCarbon Marketplace is Australia’s only tier 1 licensed marketplace for compliant carbon credits, making it a fully regulated platform with openness and transparency at its core. MyCarbon’s tier 1 status means that all transactions are visible, secure, and auditable, ensuring credibility and a higher level of accountability.

/ Who can trade on the MyCarbon Marketplace?

Anyone. The MyCarbon Marketplace is accessible to anyone. Any licensed broker can offer access to their clients, giving individuals, businesses, and institutions regulated access to the marketplace.

/ How are carbon credits classified in the MyCarbon Marketplace?

All carbon credits on MyCarbon are classified as financial products and are held to rigorous compliance standards, aligning with Australia’s financial regulations and ensuring credibility.

/ How are trades settled and redeemed on the MyCarbon Marketplace?

Trades are settled in the exact same way as normal shares (or equities). The shares are redeemable either as carbon offsets or as transferred ACCUs, ensuring an efficient and regulated system.

/ What types of carbon credits are available on the MyCarbon Marketplace?

Currently, myCarbon lists Australian Carbon Credit Units (ACCUs), a regulated financial product issued by the Australian Government, with plans to expand to other compliant carbon credits in the future. Every credit is verified to meet established market standards, ensuring compliance and environmental impact. Unlike voluntary carbon credits such as Verified Carbon Standard (VCS), Gold Standard, and the Carbon Disclosure Project (CDP). These voluntary standards, while widely used, have faced scrutiny for lack of transparency and inconsistent reporting.

/ How does MyCarbon ensure transparency and security in carbon credit trading?

myCarbon uses blockchain technology to record the provenance of each ACCU, creating an immutable and fully auditable ledger. This technology reduces the risk of fraud or double-counting, establishing trust and security in every transaction. myCarbon also has it’s own Clean Energy Regulator ANREU account with will always be in sync with the blockchain.

/ What fees or costs are associated with trading on MyCarbon?

MyCarbon charges fees for issuance and tokenisation services, with additional costs for redemptions. Specific fee structures are transparent and available upon request to provide clarity for brokers and investors. Note that any brokerage charges are separate and determined by individual brokers.

/ How are carbon credit prices set on the MyCarbon Marketplace?

Prices are transparently driven by supply, demand, and market trends, with real-time price and trading updates ensuring open and transparent pricing—just like in traditional share trading